しんかわ社会保険労務士事務所:〒133-0056 東京都江戸川区南小岩7-28-11-502

しんかわ行政書士事務所 新川秀吉税理士事務所:〒272-0004 千葉県市川市原木1-4-15

Introduction

Foreigners from 20 or more to less than 60 years old who have a place of

residence in Japan are requested, in principle, to enroll in the National

Pension.

(Foreigners apply for the National Pension by themselves)

However the following foreigners are requested to enroll in not the National

Pension but the Employees'Pension Insurance.

・ Full-time employees who work for a corporation

・ Full-time employees working for some personal business which always

employs five or more.

(A corporation applies for the Employees'Pension Insurance)

※A corporation is requested to enroll in the Employees'Pension Insurance

even if it employs less than five employees.

Contribution

The monthly conribution amount for the National Pension is 15,100 yen from

April, 2010 to March, 2011.

Foreigners make full contribution payment.

About the Employees'Pension Insurance, a company and foreigners make by

halves of the contribution payment, respectively.

The monthly contribution amount for the Employees'Pension Insurance to a

foreigner is about 8,000 yen 〜 50,000 yen, depending on his/her salary.

The contribution is deducted from his/her salary every month.

Pension Benefits

Both the National Pension and the Employees'Pension Insurance benefits are

classified into the following three.

・Old-age pension (The pension will be paid when a foreigner becomes

65 years old)

・Disability pension(The pension will be paid when a foreigner becomes

disabled)

・Survivors' pension(The pension will be paid when a foreigner dies)

Disability pension or Survivors' pension will be paid regardress of

the length of the enrollment period of pension when a foreigner becomes

disabled or dies during the enrollment period of pension.

However Old-age pension will not be paid unless a foreigner has enrollment

periods of pension more than 25 years.

Since it is difficult to have enrollment periods of pension more than 25 years

for a foreigner, Lump-sum Withdrawal Payments is provided.

Requirements to receive the Lump-sum Withdrawal Payments

The foreigner who meets all requirements from 1 to 4 can receive

the Lump-sum Withdrawal Payments by filing a claim within 2 years after

leaving Japan.

1. Persons who do not possess Japanese citizenship

2. Persons who have Employees' Pension Insurance contributions for six

months or more or National Pension Insurance contributions for six

months or more

3. Persons who have never been qualified for receipt of pension benefits

4. Persons who do not have a place of residence in Japan

Persons who have an enrollment period of pension in countries which have

concluded agreements of aggregation of pension with Japan (as of January,

2010, Germany, the United States, Belgium, France, Canada, Australia,

Netherlands and Czech) may receive Japanese as well as agreement partner

countries' pension by summing up enrollment periods of pension on the

specific requirements. However, if you receive the Lump-sum Withdrawal

Payment, please note that the period corresponding to the paid amount

cannnot be summed up.

Benefit Amount

●National Pension Insurance Benefit Amount

| Number of your contributed months | Payments if ; |

| Your last contribution was made between Apr.2010-Mar.2011 | |

| 6 - 11 months | 45,300 yen |

| 12 -17 months | 90,600 yen |

| 18 - 23 months | 135,900 yen |

| 24 - 29 months | 181,200 yen |

| 30 - 35 months | 226,500 yen |

| 36 - months over | 271,800 yen |

●Employees' Pension Insurance Benefit Amount

Formula

Your benefit amount = Your Average Standard Remuneration x Benefit

Multiplier

For example, the amount of the Lump-sum Withdrawal Payments is about

550,000(*) yen when the foreigner of the salary of 200,000 yen works in Japan

for three years and went back to his/her own country.

(*)The amount if the last month of payment is 2010 and the coverage is only

from April 2003.

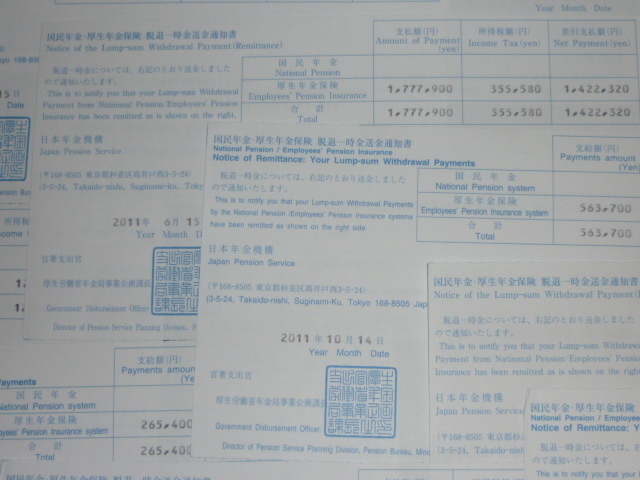

Procedure to claim the Lump-sum Withdrawal Payments

You send the following documents to Japan Pension Service.

・Lump-sum Withdraw Payment Arbitration Bill (National Pension/Employees'

Pension Insurance)

・a photocopy of your passport (page(s) showing date of your final departure

from Japan, your name, date of birth, nationality, signature and resident

status)

・document of "Bank's Name", "Branch Name", "Branch Address", "Account

Number" and "Holder's Name" (must be the claimant himself/herself)

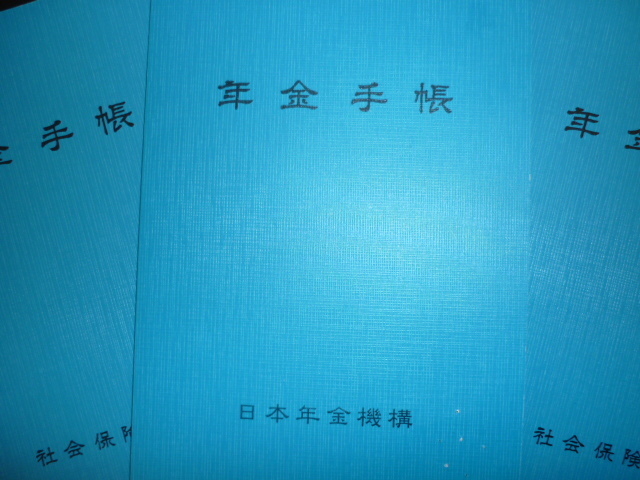

・your pension handbook

Regarding National Pension, the total amount of the Lump-sum Withdraw

Payment is transferred to your designated bank by submitting the documents

mentiond above.

Regarding Employees'Pension Insurance, only 80% amount of the Lump-sum

Withdraw Payment is transferred to your designated bank by submitting the

documents mentiond above and a 20% income tax is imposed.

(In the above example, income tax of 110,000 yen (20% of 550,000 yen) is imposed)

Income Tax of Employees'Pension Insurance

Income is classified into Interest income, Dividend income, Employment

income, Business income, Real estate income, Capital gain, Occational

income, Miscellaneous income, Retirement income and Forestry income

in Income tax law.

Lump-sum Withdraw Payment of Employees'Pension Insurance is one of

the retirement incomes.

The formula of the retirement income is as follows.

Retirement income = (the amount of the Lump-sum Withdraw Payment -

the amount of the deduction(*)) x 1/2

(*)400,000 yen x years of working (if years of working are less than 20 years)

At least 800,000 yen

In the above example, since the amount of the the Lump-sum Withdraw

Payment is 550,000 yen and years of working is 3 years, the retirement

income is as follows.

Retirement income = (550,000 yen - 400,000 yen x 3) x 1/2 = 0(*)

(*) Zero if negative

Income tax is zero because the retirement income is zero.

Therefore, you can receive tax refunds of withheld 110,000 yen.

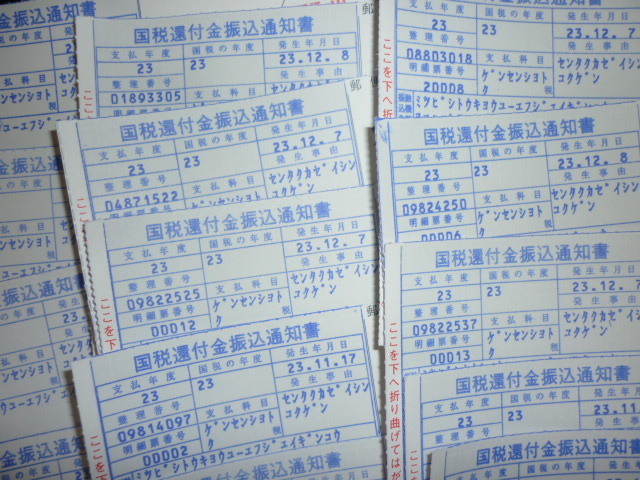

Claims for tax refunds can be made at tax offices. Before leaving Japan,

please submit a "notification of tax agent" to the relevant tax office and

designate your agent.

An original document of the "Notice on Payment of the Lump-sum Withdrawal

Payment"(Entitlement)," which will be sent to you with remittance of the

Lump-sum Withdrawal Payment, should be sent to the tax agent.

The tax agent shall make a claim for the tax refund on behalf of the claimant.

お問合せ・ご相談はこちら

ご不明点などございましたら、

お電話もしくはお問合せフォームよりお気軽にご相談ください。

- 在留資格認定証明書交付申請

- 在留資格変更許可申請

- 在留期間更新許可申請

- 就労資格証明書交付申請

- 資格外活動許可申請

- 再入国許可申請

- 在留資格取得許可申請

- 永住許可申請

- 帰化許可申請

- 外国人の雇用・労働問題

- 外国人の税務問題

- 外国人の起業

- 外国人のための厚生年金・国民年金の脱退一時金

(Lump-sum Withdrawal Payments)

- 在留資格

外国人の雇用・労働問題

外国人の税務問題

しんかわ

社会保険労務士事務所

住所

しんかわ社会保険労務士事務所

〒133-0056

東京都江戸川区南小岩

7-28-11-502

しんかわ行政書士事務所

新川秀吉税理士事務所

〒272-0004

千葉県市川市原木1-4-15